Trump's Unexpected Re-Election: The Revival of America First?

President-elect Donald Trump has secured a second term as U.S. president despite facing numerous legal challenges. His re-election was an unexpected outcome on the global stage, leaving countries that suffered under his previous administration's America First policies bracing for renewed challenges. South Korea is one of the nations likely to tread carefully under the new Trump administration. Let’s examine Trump’s campaign policies and identify potential investment opportunities for South Korean investors.

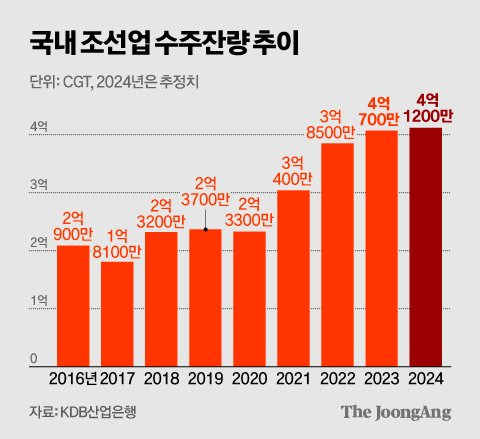

U.S.-China Trade War Boosts South Korean Shipbuilding

South Korea has long been proud of its world-class shipbuilding expertise. In recent years, however, China has aggressively supported its own shipbuilding industry, surpassing South Korea in new orders and offering cheaper alternatives. This, combined with technological advancements, has posed challenges for South Korea’s shipbuilding market over the past decade. President-elect Trump has pledged to impose a 60% tariff on Chinese goods, which would significantly curtail U.S.-China trade. This policy, coupled with China’s ongoing real estate crisis and oversupply of steel, is expected to hinder China’s global competitiveness. South Korea’s leading steelmaker POSCO has already faced losses due to falling steel prices, forcing partial shutdowns of production lines. However, the shipbuilding industry may benefit from these low steel prices. Ships are primarily constructed using steel (accounting for 99% of materials), making the cost of steel a critical factor in shipbuilding profitability. Furthermore, geopolitical disruptions such as the U.S.-China trade war, the Ukraine-Russia war, and conflicts in the Middle East have created inefficiencies in global trade routes. Longer shipping distances have increased demand for vessels, amplifying the shipbuilding market’s recovery potential. While Chinese shipbuilding has caught up technologically, politically aligned nations may prefer working with South Korea, even at higher costs, due to its stability and reliability. Reports indicate a slow revival in the shipbuilding sector, presenting a promising investment opportunity.

Trump’s Pro-Cryptocurrency Policies

When Bitcoin first emerged, traditional economists dismissed it as a scam. A decade later, its value has skyrocketed, exceeding 100 million KRW per Bitcoin. President-elect Trump has expressed a pro-cryptocurrency stance during his campaign, likely acknowledging the growing influence of crypto-asset holders among voters. More strategically, Trump may see Bitcoin as a future global reserve currency that the U.S. must dominate. Trump’s America First rhetoric underscores his desire to maintain the U.S. dollar’s global influence. Despite interest rate cuts, which typically weaken a currency, the U.S. dollar has remained strong. This could be attributed to increased Bitcoin acquisitions, which lock up liquidity in crypto exchanges and reduce currency circulation. A strong dollar benefits the U.S. as a net importer, addressing its growing trade deficit. While a strong dollar might not favor the long-term U.S. economy, it offers short-term advantages for industries reliant on imported raw materials. Trump’s policy of repatriating manufacturing from China to the U.S. has already prompted companies like Samsung, Hyundai, LG, SK, and Hanwha to establish U.S.-based facilities, aligning with his goals. Monitoring U.S. monetary policy will remain essential, as exchange rate fluctuations will significantly impact profit margins in these markets. Trump’s recognition of Bitcoin’s growing significance and his favorable stance toward cryptocurrency suggests a strategic intent to maintain a strong dollar policy. With Bitcoin’s value poised to rise in the future, it presents a viable long-term investment consideration.

| Click if you want to read another article recommended by JadeWolveS. |

What Is Elon Musk Targeting After Electric Vehicles?

Elon Musk's Next Venture After Electric CarsElon Musk, the CEO of Tesla, SpaceX, and X (formerly Twitter), is renowned for his diverse business ventures. In 2024, Musk played a significant role in securing Donald Trump's re-election, which has bolstered po

jadewolves.tistory.com

'청랑 경제 식견 > 청랑 투자 식견' 카테고리의 다른 글

| 비트코인을 바라보는 두 가지 시선은? (3) | 2024.12.16 |

|---|---|

| 한국경제 위기가 곧 투자 기회인 이유는? (5) | 2024.12.16 |

| What Is Elon Musk Targeting After Electric Vehicles? (0) | 2024.11.23 |

| 트럼프 당선으로 이익을 얻는 미래 투자처는? (3) | 2024.11.22 |

| 일론 머스크가 전기차 다음으로 노리는 먹거리는 무엇일까? (7) | 2024.11.21 |

댓글